How IBM is helping accelerate AI adoption and application centric connectivity

IBM Journey to AI blog

FEBRUARY 26, 2024

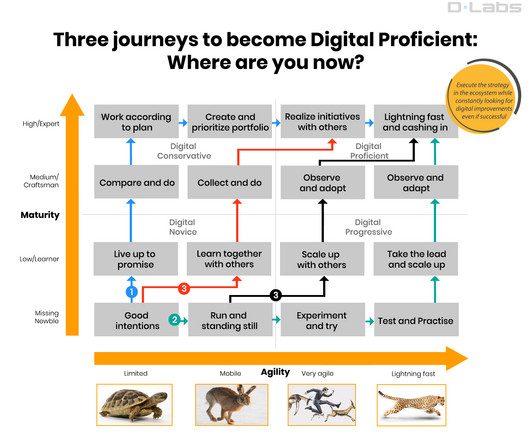

Accelerating AI adoption and skills for the telecoms sector The AI skills gap is very real: executives estimate that 40% of their workforce will need to reskill as a result of implementing AI and automation over the next three years. Easy to say, hard to do – at least without the right toolsets.

Let's personalize your content