AI News Weekly - Issue #375: AI Is Game Changer for Election Interference, FBI Warns - Mar 7th 2024

AI Weekly

MARCH 7, 2024

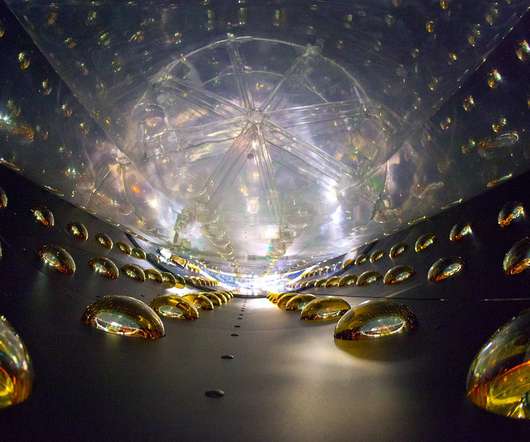

Applied use cases The job applicants shut out by AI: ‘The interviewer sounded like Siri’ When Ty landed an introductory phone interview with a finance and banking company last month, they assumed it would be a quick chat with a recruiter. Robot ships: Huge remote controlled vessels are setting sail It sounds like science fiction.

Let's personalize your content