The Dangers of AI Chatbots – And How to Counter Them

Unite.AI

JUNE 12, 2023

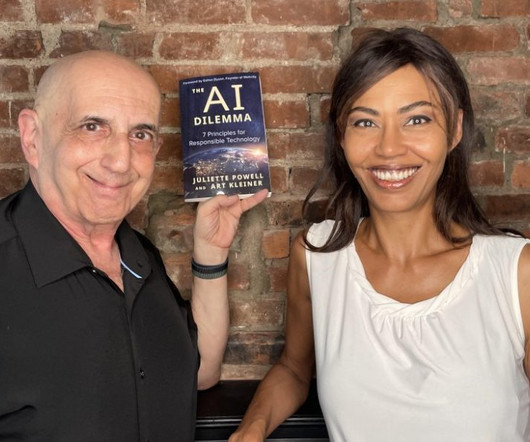

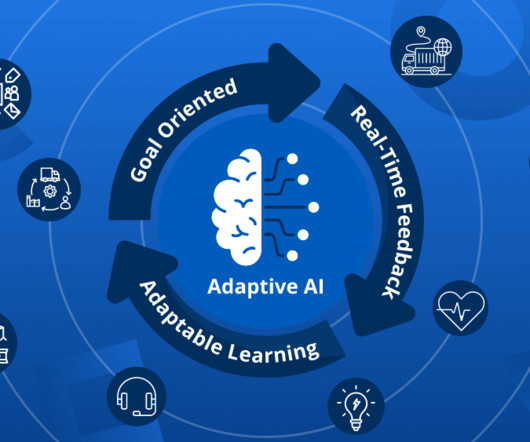

A prime example is Amazon’s scrapped hiring bot. These involve cyber attackers imitating trusted organizations such as banks or government bodies. Once thought of as just automated talking programs, AI chatbots can now learn and hold conversations that are almost indistinguishable from humans. But are bots dangerous?

Let's personalize your content